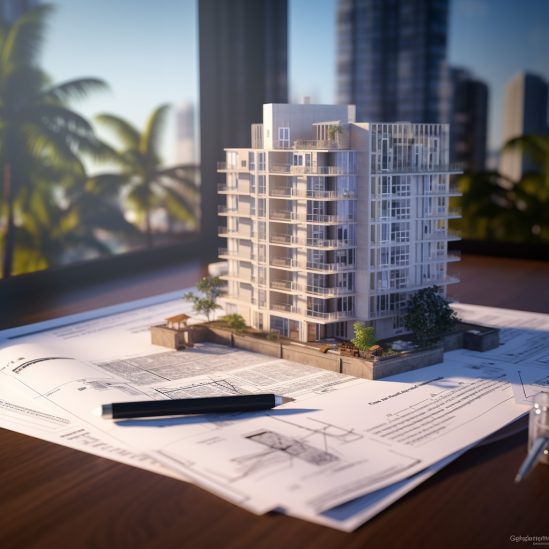

A condo in Miami is a coveted asset, and as the owner of one, you can expect ample rewards. At the same time, it’s essential to be mindful that specific responsibilities are attached to such ownership – like having insurance policies for any unexpected disasters or accidents. We’ll look at some insurance plans for Miami condo owners to ensure protection when times get tough.

Insurance Plans for Miami Condo Owners

H06 Insurance Coverages You Can Purchase

HO6 condominium homeowner’s insurance policies protect your property and finances from the unexpected. This specialized form of home protection covers legal risks like theft, fire damage, or water damage. It also provides a layer of liability coverage tailored to condo owners’ specific needs.

Dwelling Coverage

Protect your condo from costly repairs with dwelling coverage. This type of policy can cover any damage to items that are permanently affixed within, such as walls, flooring, and countertops – plus, it covers changes or improvements you may have made.

Personal Property

Personal property insurance offers peace of mind, covering various items that might be lost or damaged – from clothing to furniture. Whether it’s inside your condo or somewhere else, you’re protected in the event anything is stolen or damaged.

Personal Liability

Personal liability insurance provides peace of mind if someone has an accident at your house. It will also cover dog bites and other injuries. When you get a quote for coverage, ask specifically about pets so that any damages they could cause are also covered.

Loss Assessment

As a condo owner, you may be responsible when common areas suffer damage. Any costs exceeding the limits of your condominium association’s insurance policy could require an out-of-pocket contribution from you to cover the repairs. Florida law requires each unit owner to have their own $2,000 loss assessment coverage in addition to any provided on behalf of the entire building.

Loss of Use

As a Miami condo owner, you are responsible for covering damages to areas that exceed your association’s insurance policy limits – up to $2,000 per law. An appropriate and necessary addition is loss assessment coverage within your property insurance plan so unexpected expenses won’t put too much of a burden on owners when they occur.

Hurricane Coverage

Uninsured condo owners in hurricane-prone areas face the harsh reality of footing bills for costly destruction caused by named storms. Protect your home and wallet with proper hurricane insurance coverage.

Flood Insurance

Flood insurance is a must for coastal areas prone to hurricanes and tropical storms. King tides and storm surges can cause catastrophic damage on low-lying land with poor drainage, prompting the need for residents to include it in their condo policies before disaster strikes.

Sinkhole Coverage

Florida is no stranger to sinkholes, as the limestone deposits beneath its surface make it particularly vulnerable. These geological occurrences can devastate property owners; floor buckling and foundation cracking are just a few of the costly consequences of sinkhole activity in condos.

We Love Miami!

Are you considering buying or selling a home in the Coral Gables/Miami area? If so, we’d love to help you! Please click here for our contact page, and we’ll reach out to you promptly. Would you like to see more great info from JMK Real Estate? If so, please click here for our blog page. Please click here for our “About Us” page to learn more about my team.

Thanks for visiting!